Sample Earnings Statement

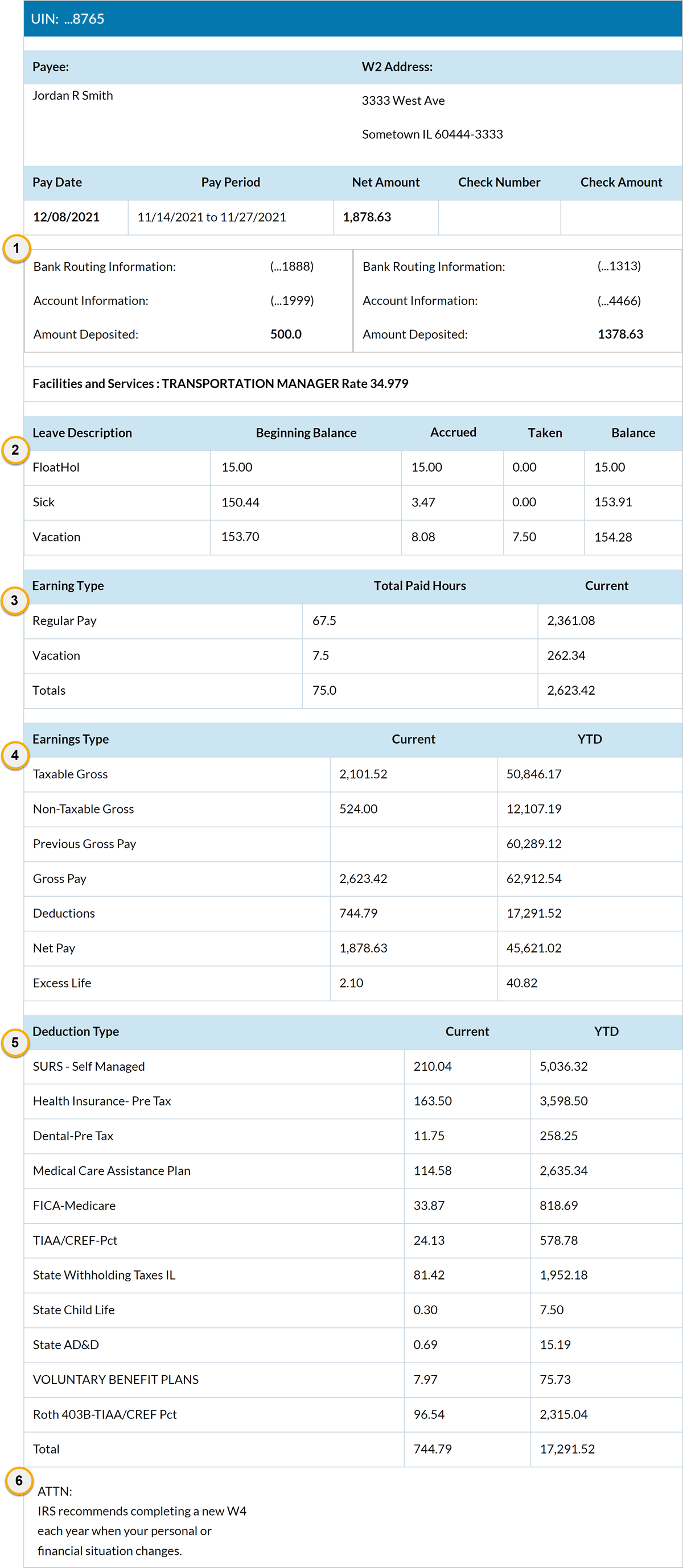

The following is a sample of the online earnings statement for a non-exempt employee paid bi-weekly. Your statement may look different depending upon your situation. Numbered sections on the sample are described below the image.

- Direct Deposit: Direct deposit account information is provided here.

- Leave Benefits Summary: Non-exempt benefit eligible employees paid bi-weekly will see the leave amount accrued, used, and a running balance reported on the earnings statement each pay period. Discrepancies in benefit time should be reported to the employee's department and the Human Resources Records office. Academic and exempt (not overtime eligible) Civil Service employees: For help interpreting the Leave Balance Summary on your earnings statement, please read the Leave Balance Announcement.

- Earning Type: Details the type of earnings being paid or reported on the pay period.

- Wages: Regular pay, overtime, other pay differentials.

- Leave Benefits Used: Floating holiday, sick, vacation, compensable time (in lieu of overtime), etc.

- Taxable Benefits: Taxable benefits are subject to withholdings, such as federal and state income tax, State University Retirement System (SURS), and Medicare (if applicable). Examples of taxable benefits include (but are not limited to) the taxable amounts relating to the personal use of employer provided vehicles, country club dues paid for members on behalf of the university, moving expenses, complimentary event tickets, car mileage (value of fuel for personal commuting use of a university vehicle), gifts, per diem amounts reimbursed to an employee exceeding the Internal Revenue Service limits, expense reimbursements (greater than 60 days), tuition waiver amounts greater than $5,250, miscellaneous taxable benefits, union taxable vacation pay, and nonresident housing expenses.

Note: Excess Life and Non-Qualified Taxable Benefits (value of benefits supplied to a domestic partner of an employee) are listed in the Earnings Type section below.

- Earnings Type: Lists the pay by taxable or non-taxable gross, deductions, net pay, and certain taxable benefits (if applicable).

- Taxable Gross: Taxable gross represents gross earnings plus taxable benefits reported after all non-taxable deductions are subtracted.

- Non-taxable Gross: Amount of deductions which are pre-tax based on Internal Revenue Code. This amount is not reported as wages on Form W-2.

- Previous Gross Pay: Previous gross pay is the calendar year-to-date (YTD) gross pay not including this pay period.

- Gross Pay: Gross pay is the total amount of cash compensation received before taxes and other deductions are subtracted.

- Deductions: The Current deductions summary provides the dollar amount of deductions taken in this pay. The YTD total includes both current and terminated deduction totals accumulated since January 1.

- Net Pay: Net pay is the dollar amount left after all deductions and withholdings are subtracted. This is the amount sent as a direct deposit to the employee's bank account or the amount of the payroll check issued to the employee.

- Excess Life: Excess life is a taxable benefit based on your employer-provided term life insurance coverage above $50,000.

- Non-Qualified Taxable Benefit: The taxable value of benefits supplied to a domestic partner, civil union and/or child of a civil union partner.

- Deduction Type: Lists the withholdings and deductions reducing your gross pay on the current pay event.

- Statutory deductions are required by either federal or state statute, such as federal or state income tax (Form W-4), SURS, or Social Security and Medicare (FICA).

- Voluntary deductions are elected by the employee to be deducted from pay, such as health, life and dental insurance.

- Involuntary deductions are ordered by a court of law to be deducted, such as child support, garnishments, and other federal/state involuntary deductions.

- Alerts: Contains important and timely messages regarding your pay.

UPB Service Portal

Select your university to create a service ticket and access support knowledge.